Welcome Back

Sign up for IRG account Login with your existing IRG account

Are you a Real Estate Professional? Register here.

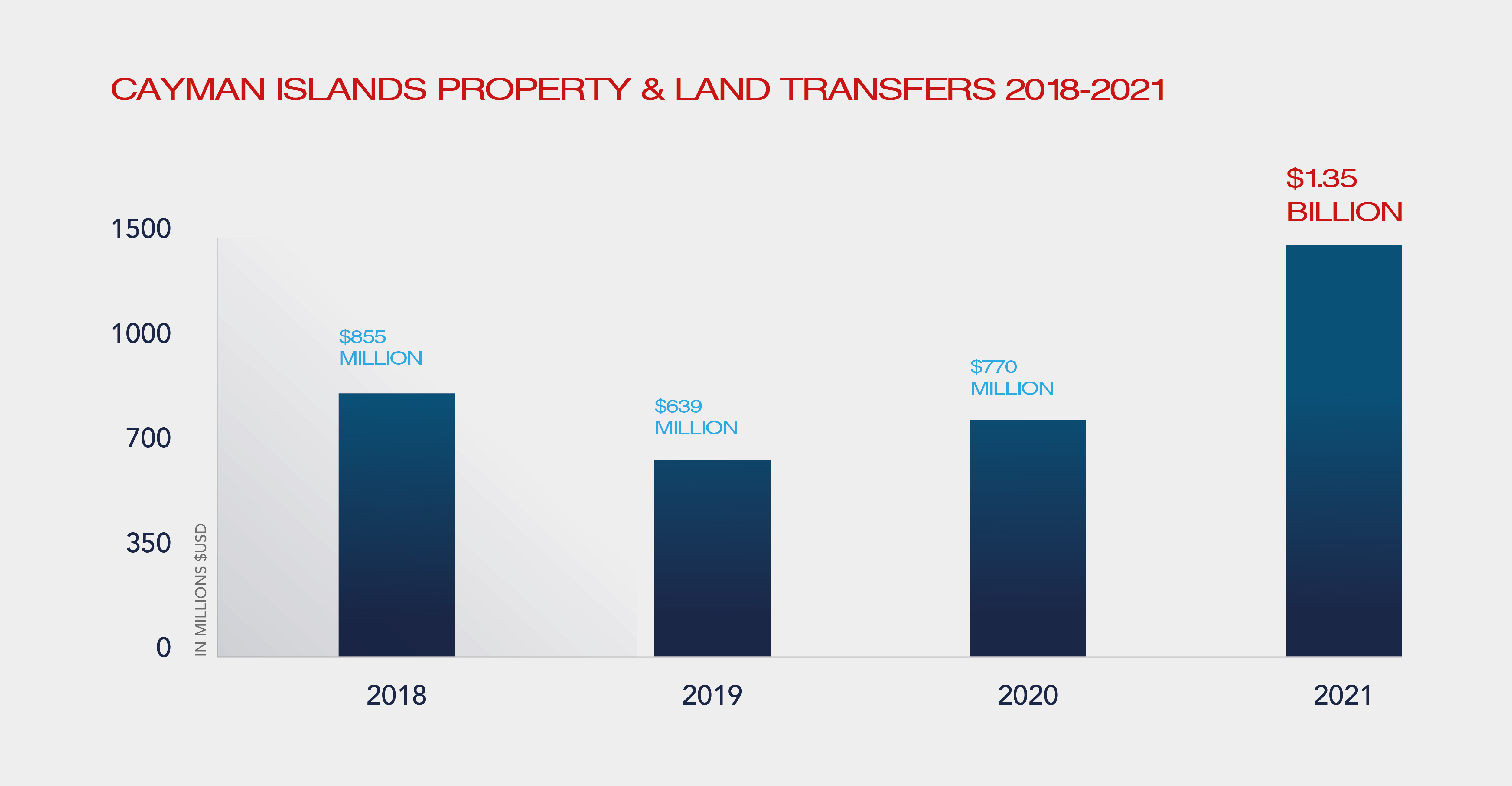

Prior to the global pandemic in 2020, the real estate market in the Cayman Islands had seen year-on-year improvements since 2017. There were increased prices across most sectors particularly for land and residential properties including both luxury and entry-level markets. Real estate prices were rising to record levels, with sales constantly over CI$800 million (US$1billion). As the world descended into chaos when the coronavirus pandemic hit in March 2020, the Cayman Islands, thanks to a proactive closure of the borders, twinned with an efficient lockdown plan, was not only able to protect its own people, but also recover quickly, steering towards a stable economy once again by the end of a tumultuous year. Cayman became a shining beacon, offering the advantages of safety and security in a very uncertain world. However, 2021 was still approached cautiously by many. There was a sense of unpredictability, fringed with hope that things would get better. To a degree the same feeling of uncertainty was mirrored across Cayman’s real estate industry as we anticipated the year ahead. IRG’s 2021 market report predicted a V-shape recovery and while we still entered 2021 with some nervousness, the real estate market in the Cayman Islands thankfully reflected the local economy’s bounce back, and in fact was probably the most important contributor towards it. That said, the welcome surprise was still to come and none of us could have predicted just how strongly the real estate market in Cayman would recover in 2021. Reflecting now, 2021 was more than a record year for Cayman real estate. We saw the industry take stock, recalibrate, and move forward to a totally new level of confidence and investment. The results speak for themselves – 2021 saw the highest number of properties sold, the highest total value of properties sold, as well as the highest average sold unit value in Cayman for over a decade. It’s difficult to highlight the success of the real estate market in Cayman in 2021 without first providing some context of the damage that was done as a result of the pandemic in 2020. Following the arrival of pandemic pandemonium, with closed borders, zero tourism, lockdown restrictions and extreme market uncertainty, CIREBA property sales dropped to new lows between January and April 2020. However, that was history, and as we reported in our Jan 2021 market report, this decline was temporary in the shortest-term definition of the word. As the Cayman Islands Government and Private Sector began implementing initiatives to help energize the country’s economy during 2020, including The Global Citizen Concierge Programme, combined with an increased uptake on residency through The Cayman Islands Residency for Persons of Independent Means, HNWIs and UHNWIs were welcomed with open arms into the Cayman economy and, by definition, into the real estate market. In addition, local residents, who themselves had substantial spending power, took advantage of the additional time they were spending on island, many of them choosing to upgrade or invest in new homes. Money was beginning to be injected back into the economy through the purchasing of highly valued properties, pre-construction purchases and raw land sales. The removal of all lockdown and social distancing restrictions, as the rest of the world were still keeping their distance and wearing facemasks, and the fact that Cayman was COVID-free, allowed us also to physically get back out there – showing properties and making sales – even if in many cases virtually via Facetime or similar apps. The stories of HNW buyers viewing and inspecting their dream home virtually and buying before they’ve even stepped into it are more than anecdotal and became a trend which helped lead Cayman to its real estate record year. While the rest of the world continued to struggle navigating numerous lockdowns and exponential rises in COVID-19 cases, the Cayman Islands’ recovery also positioned us quickly as an attractive location for relocating expatriates, in turn increasing demand and pushing up prices. By March and April 2021, property sales were climbing, with totals of 104 and 118 sales in Cayman respectively according to CIREBA data. There was a flurry of activity in buying as the stamp duty window transfer closing approached at the end of June. We saw pre-construction purchases being fast-tracked to ensure that deadline was met. According to local Lands and Survey data, July saw the highest property transfer value, as well as the highest number of property transfers in 2021. The purchase of land was also on the up, with CIREBA data citing more land sales in September 2021 than residential property sales. Land banking, the practice of aggregating parcels of land for future sale or development, was also on the rise in late 2021, as many people invested in this quickly diminishing asset. Many found themselves looking to purchase following savings they had made throughout lockdown, as well as accessing their pensions early. This increase in land banking will ultimately affect predictions for 2022, as the land will be sold on for more, or the new builds will begin breaking ground. Low interest rates available to borrowers also fueled demand for all types of properties and a lack of supply led to a continuous increase in prices throughout the year. A rising cost in construction, which was seen globally, affected the island significantly. Shipping costs increased and a shortage of concrete on island resulted in major development projects being halted. The shortage was due to an unanticipated increase in construction, where supply couldn’t keep up with demand. Slowly, these issues have begun to redeem themselves, although construction costs do remain high, supply chain issues should resolve themselves as we move through 2022 and the world gets used to living and working in a new Covid endemic, as opposed to pandemic reality. When it came to luxury, in May of 2021, James O’Brien, Head of Luxury Property at IRG, along with the Luxury Team, oversaw the sale of Villa del Mare, a beautiful beachfront estate in Cayman Kai. This impressive Spanish-style mansion was IRG’s most viewed, liked and enquired about property in 2021. The house was one of the first properties we marketed through virtual tours and bespoke websites and is a great showcase of what can be achieved through smart pivoting of marketing strategies. The sale was also a great example of the increase in popularity of remote properties, as well as how buyers looking to invest were doing so in countries like Cayman who handled the pandemic well – finding a home in a jurisdiction which provided stability and security to those moving there. It also showed how evolving our marketing strategies to that of a more virtual experience can lead to great results, regardless of being able to physically visit our properties. The launch of our ORACLE video series and our exciting rebrand in June allowed us to elevate new marketing digital-based tactics, which had been so pivotal in continuing to bring properties of such quality to our buyers, as well as marketing our properties so effectively for our clients locally and globally. The long-awaited announcement of the Cayman Islands’ borders reopening in October 2021 was postponed to November 2021 as cases of COVID-19 slowly began to trickle in, leaving a newly formed Government to put a halt on proceedings in order to deal with the first real influx of cases to the island. The delay in reopening the country’s border did affect pre-construction, with some overseas buyers choosing to invest elsewhere. However, with this, eventually came a higher number of listings as properties sold. Finally, in November 2021, the Cayman Islands borders reopened, and with that came a gradual influx of overseas buyers and the beginning of an inevitable population surge as people sought to enjoy the pleasures Cayman traditionally offered, bolstered by its enhanced reputation as a pandemic bolthole: if it ever happens again where would you rather be? Short-term rentals and the purchase of luxury holiday homes are showing a steady increase and the tourism industry is finally beginning to get back on its feet after a long hiatus; further good news for the economy with March occupancy levels looking much healthier. A number of large-scale projects are now underway across the Cayman Islands, including a hotel and residences development that we are particularly excited about – The Residences at Mandarin Oriental Grand Cayman. As we look forward to working alongside one of the most prestigious luxury brands in the world as the official local sales and marketing partners, it’s clear to see that confidence in developers both locally and overseas is on the rise as we enter 2022. 2021 was a record year for real estate transactions. The lack of initial supply, combined with high demand, resulted in an increase of pricing across all sectors of the market. In 2021, there were 1037 properties sold within CIREBA, compared to 700 sold in 2020, a 48% increase on the prior year. Looking at the last 11 years of CIREBA data, 2021 also saw the highest number of residential properties sold, with a total of 660; a huge number considering the trepidation faced at the beginning of the year. The numbers really do speak for themselves. 2021 saw almost CI$1.35 billion in land transfers, compared to that of the 2018 high of CI$855 million, and 2020’s impressive covid recovery figure of CI$770 million. Overall, that’s a 75% increase on the previous year’s sales volumes, and 58% higher than 2020’s figures. This incredible recovery is also clear through the large number of transactions we saw – with a total of 2,983 in 2021. These numbers were up tremendously from 2,070 transactions in 2018 and 1,970 in 2020. We also saw continued demand for office space in George Town across all sizes and asset classes. The commercial team transacted 26 leasing deals in George Town throughout 2021, as well as two large investments. We also now have over 100,000 sq ft of office space under management which continue to see rents increase through annual renewals, ranging from 3% - 5% annually. Surprising when you consider all the predictions of market occupancy declining due to work at home, but not when you consider Cayman's economic substance requirements and our desirability as a place to, yes work, but also to live and play! The ability of the Cayman Islands to handle the pandemic seamlessly and effectively was phenomenal and it is now paying off dividends. Described as a “little island in the sea standing up to the Goliath of Coronavirus” by Forbes Magazine, Cayman’s economy and population stood strong in the wake of the pandemic, and we feel strongly that 2022 will duly reward itself with a further record year. It is always difficult to speculate how long such increases will last, especially so in a new world, where we are still trying to adjust to ongoing challenges faced from the pandemic. However, we are immensely proud of and encouraged by the tenacity and positivity shown by the Cayman Islands people, businesses and government, and not least our own team as we adapted and pivoted during another challenging yet rewarding year. We are now able to enter the new year with our heads held high and a confidence in our industry of which will never be in doubt. Look out for our next blog on what 2022 and beyond holds for the Cayman Islands and IRG coming soon.

Property doubts turned into record numbers

Villa Del Mare